Get Started with Mutual Funds

3S Ka Magic: SIP, STP, SWP!

What is SIP?

Small Steps to Big Wealth

A Systematic Investment Plan (SIP) allows investors to invest a fixed amount regularly in a mutual fund, typically on a monthly basis. This approach helps build wealth over time without needing large sums of money upfront.

SIP uses rupee cost averaging, meaning the number of units bought varies with market fluctuations. When markets are low, more units are purchased; when markets are high, fewer units are bought. This strategy helps reduce the impact of market volatility.

SIP also benefits from compounding, as returns are reinvested to generate further growth, making it a disciplined and accessible way to invest long-term.

Why Invest Early

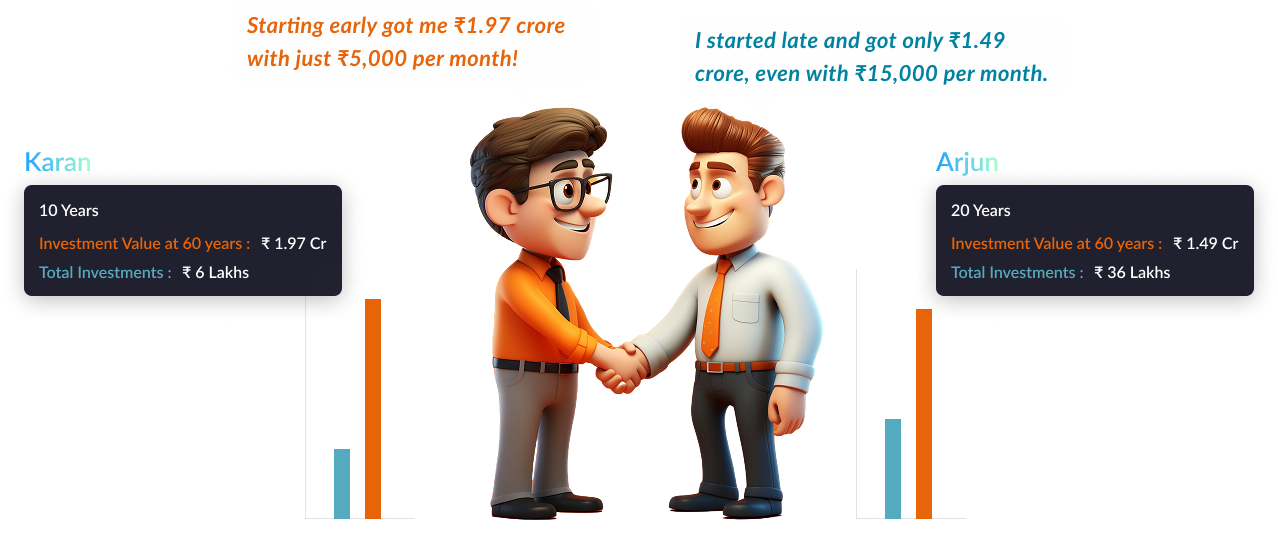

Smart Early, Grow Bigger – Your Future Thanks You!

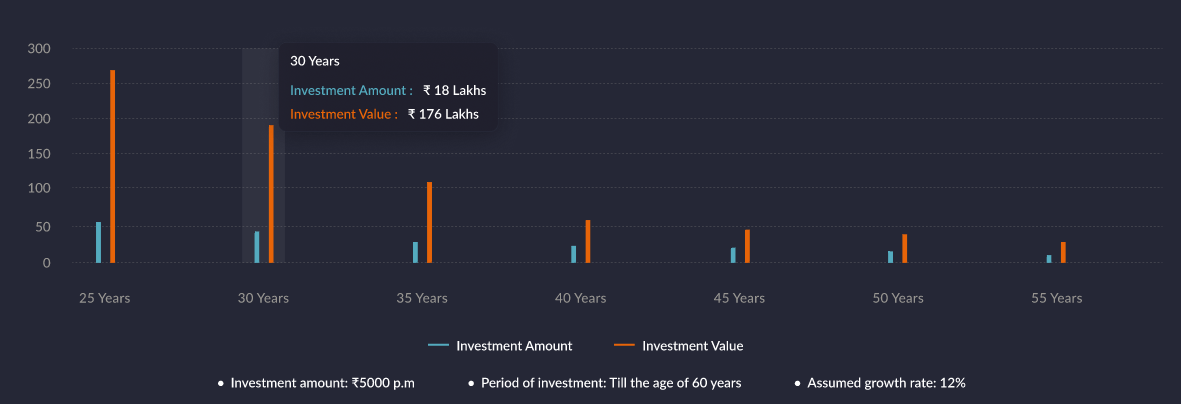

Investing at different stages

Consider the following scenario wherein ₹5,000 is invested every month till the age of 60 years.

Even a delay of 5 years in Investments can reduce wealth considerably

The above calculation is an example only for illustration purposes, purely to explain the effect of compounding on investments over a long term. The growth rate of the investment is assumed at 12%. Please note the growth rate mentioned above is purely for illustration purposes only & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund.

SIP Calculators

Calculate how much your small steps today will mean in the future.

Years

1 Year

60 Years

₹

₹ 1000

₹ 50 Cr

%

2%

16%

Total Amount Invested

₹360000

Growth / Appreciation

₹89834

Investment Value

₹449834

Figure out the right financial amount required

Years

1 Year

60 Years

₹

₹ 1000

₹ 50 Cr

%

2%

16%

Invested Amount

₹0

Growth Value

₹0

You’ll Need to Invest

₹0/ Month

This calculator will help you visualize the amount accumulated

Years

1 Year

60 Years

₹

₹ 1000

₹ 50 Cr

%

2%

16%

Future Value: With Top-up

Total Investments made through SIP & SIP TOP UP combines till the end of the investment periods

₹ 0

Capital Appreciation you will get at the end of the investment period if opted for Top UP

₹ 0

Expected Investment value at the end of Investment period by opting for SIP Top Up along with SIP

₹ 0

Future Value: Without Top-up

Total Investments made through SIP & till the end of the investment period

₹ 0

Capital Appreciation you will get at the end of the investment period by investing via SIP

₹ 0

Expected Investment value at the end of Investment period by investing via SIP

₹ 0

Disclaimer: This calculator is for illustration purposes only and is based on assumed rates of return. It does not guarantee accuracy, minimum returns, or capital protection and should not be relied upon for investment decisions. CRAMC uses information from reliable sources but does not warrant its accuracy or completeness. Users are advised to consult professional tax advisors for personalized guidance.

Why Start a SIP Today?

Build wealth, one step at a time.

Brings in Discipline

Invest on a pre-set date every month. This makes you set aside a fixed sum of money to invest in and gradually turns you into a disciplined investor.

Rupee cost Averaging

If the markets go up, you end up benefiting, but when the markets go down, you still benefit by getting more units. Thus you average out the cost of buying units.

Power of Compounding

Power of Compounding

Power of Compounding

You can invest a small amount without impacting your household budget

Timing Market

Investing through SIP helps you avoid timing the market

Achieve financial Goals

SIP is a smart tool that helps break your big goals into small amounts. Ascertain the investment amount & start investing regularly through a SIP to realise your dreams.

Investment Frequency

You can select the frequency and amount as per your convenience and need.

How SIP Works?

Your Smart step to wealth and goals!

| Regular Investment (₹) | Unit Price (₹) | Units Acquired |

|---|---|---|

| 2000 | 10 | 200 |

| 2000 | 9.7 | 206.19 |

| 2000 | 9.97 | 200.60 |

| 2000 | 10.07 | 198.61 |

| 2000 | 10.12 | 197.63 |

Total investment

₹ 10,000

Total units purchased

1003.03

Average cost price

₹ 9.97

By opting for SIP, investor would have 1003 units at an average price of 9.97. Had the investor opted for lump sum investment of ₹10,000, investor would have got 1000 units at 10. SIP enables one to invest across market cycles thus bringing the cost price down, which contributes to the returns on investment.

Disclaimer: The above example is only for illustration purposes. It should not at any point of time be construed to be an invitation to the public for subscribing to the units of Canara Robeco Mutual Fund Scheme.

WhyInvest Systematically?

Your smart step to wealth and goals!

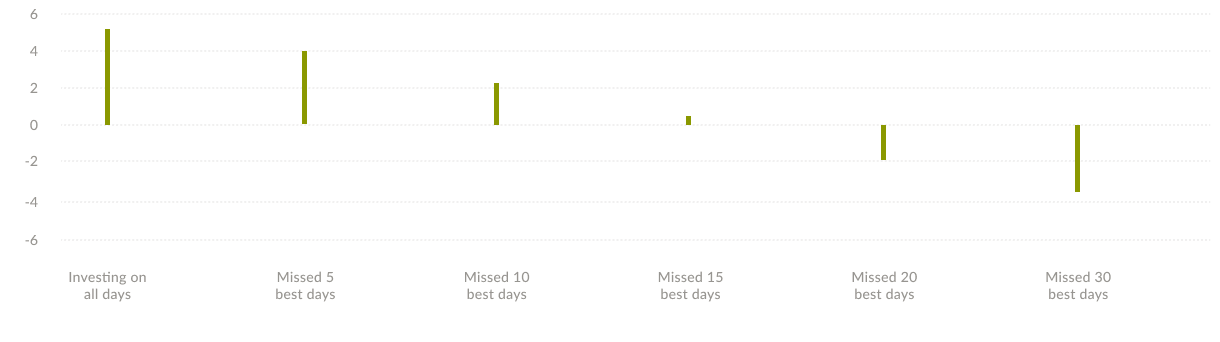

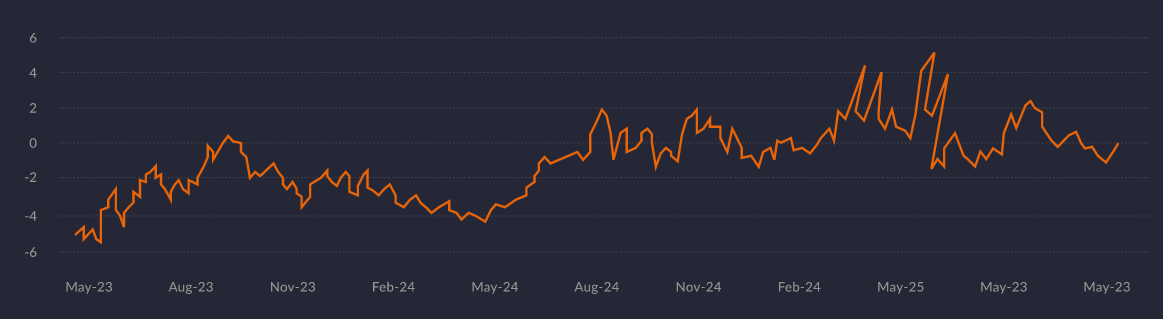

The below chart shows how staying invested for all days is beneficial than timing the markets:

Source: MFI Explorer, Performance as on 30th April, 2020. Above graph represents the performance based on 1 year (CAGR) rolling return for the last 10 years.

What is STP?

STP: Smart Moves for Steady Growth

A Systematic Transfer Plan (STP) is a mutual fund facility that lets investors transfer a fixed amount at regular intervals from one scheme to another within the same fund house. It is often used to gradually move investments from debt funds to equity funds or vice versa, depending on financial goals.

STPs help manage market volatility and ensure disciplined investing by spreading investments over time. This approach offers benefits like rupee cost averaging and better risk management, making it a popular choice for long-term investors.

However, each transfer is treated as a redemption from the source scheme, which may have tax implications, such as capital gains tax. Despite this, an STP is an effective tool for systematic and balanced portfolio management.

Benefits of STP

Build wealth, one step at a time.

Market Timing

Investing through STP helps to avoid the risk of timing the market.

Dual Benefit

Investor earns the combined returns from both the asset classes

Goal Based Investing

STP aims towards fulfilment of financial goals over a period of time

Smart Diversification

Allocation to more than one asset class also allows one to diversify the portfolio risk

Rebalancing Portfolio

STP helps in rebalancing the portfolio between two asset classes being a prudent risk management practice

Who requires STP ?

Start Early, Grow Bigger – Your Future Thanks You!

Boost long-term growth by using the STP route to shift from low-risk investments to high-return opportunities!

How to Start a Mutual Fund STP

Seamlessly Grow Your Investments with STP!

Performance of Debt & Equity Markets

Market Performance

- Debt provides STABILITY to the overall portfolio

- Equity helps in generating POTENTIAL RETURN

Source: MFI Explorer, Performance as on 30th April, 2020. Above graph represents the performance based on 1 year (CAGR) rolling return for the last 10 years

What is SWP?

SWP: Your Gateway to Steady Income and Financial Freedom!

A Systematic Withdrawal Plan (SWP) allows investors to withdraw a fixed amount from their mutual fund at regular intervals while keeping the remaining investment active. It ensures a steady cash flow without requiring a full withdrawal, making it a smart way to manage finances.

Investors can choose the withdrawal frequency—monthly, quarterly, or annually—based on their needs. This approach helps maintain financial stability while allowing the remaining funds to grow in the market. It’s especially useful for retirees or those seeking passive income.

SWP also offers tax benefits compared to lump-sum withdrawals. Since the withdrawn amount includes both capital and gains, it can help optimize tax liability, making it a flexible and efficient financial strategy.

Flexibility under SWP

Tailor Your Withdrawals, Your Way!

An SWP (Systematic Withdrawal Plan) is a smart and flexible way to withdraw a fixed amount from your mutual fund at regular intervals. It provides control over your cash flow, allowing you to choose the withdrawal frequency, duration, and amount based on your financial needs.

Withdrawal Amount

Decide how much you want to withdraw regularly.

Frequency

Choose between monthly or quarterly withdrawals.

Duration

Set the end date for receiving payouts

Benefits of SWP

Build wealth, one step at a time.

Meet Financial Goals

Plan goal-specific spending effectively to achieve your financial aspirations.

Benefit From Payouts

Ensure regular cash flows based on your financial needs and lifestyle.

Secure Lifetime Support

Manage expenses efficiently after retirement with sustainable financial support.

Avail Tax Benefits

Maximize potential tax-efficient returns while securing your financial future.