You’re new to investing. It sounds exciting.

You’ve heard that people have made 10 X on that one stock and been able to spend the kind of money they never dreamed they could. You’ve also heard that people have lost all they possessed in the downturn.

Clearly there’s money to be made but also lost.

How will you, a novice figure out what you should invest in? You’ve also heard that there are all sorts of ‘advisors’ out there trying to sell you financial products for their commission. And you don’t know enough about investing to even judge whether these advisors are genuine or not. So, here’s what we suggest:

Understand your financial needs and goals first – both short term and long term. Do you want to fund your honey moon, buy a home, fund your child’s education, plan for your retirement? Once you know your financial goals, you can determine how much money you need to achieve them.

Figure out when you need the money i.e. your time horizon.

Know your risk appetite. Are you the type of person who won’t sleep at night if the stock markets fall or are you a risk taker, willing to risk it all for the prospect of making it big? Maybe you are somewhere in between the two extremes but lean towards safety?

Once you have the answers above, look into the financial products that will help you fulfill your goals.

There are several investment options to choose from right from buying gold, to buying property, investing in companies through debt or equity and the list goes on. Investing requires research, regular monitoring and experience.

Many of us might be tempted to invest directly in the stocks of a few companies that we know and which we expect to do well. But do we really know these companies inside out? Have we analyzed their annual reports, the industry they are in, their competitors, their business-model, cost-efficiency, quality of their management? No? No time? Not enough knowledge on what to research?

Then, as a first time investor, we suggest you start with mutual funds because:

They are managed by seasoned professionals If you feel that mutual funds are the way to go, then you need to decide what type of mutual fund suits your needs. Now, let’s look at the various types of mutual fund options:

- Equity Funds

- Debt Funds

- Balanced Funds

Equity funds generally hold shares of companies that are listed on the stock exchange. Buying a stock in a company basically means that one becomes partly an owner of that company. What this means is that as the company does well and grows, the stock price could appreciate, depending on the specific circumstances of the company and the general economic conditions. Hence as an owner, investor in the stock, one immediately benefits from this. But the downside is that the reverse is also true. If the company fails to perform, the stock price could come down. Equity mutual funds have the potential to provide high upside but your capital may not be protected. If you are the sort of person who has long term financial goals and can afford to take risks in return for potentially higher rewards, an equity mutual fund could suit your needs. The rule of thumb is that you can afford to take more risks in your youth than as you approach retirement since your time horizon is much longer, which increases the likelihood that equities will perform well and give a goeturn.

Debt funds invest your capital in bonds or money market instruments. Investing in these instruments doesn’t make you owner of a company like equity would, but you become basically a lender and the company is the borrower of the amounts invested. The interest rate is agreed. So you know in advance what your investment will be worth over a period of time. In general the company will pay back the borrowed amount at the end of a certain period. The risks are limited as is the upside. If you need to ensure that your capital is protected but still would like to earn more than you would in fixed deposits, debt mutual funds are a good option. Debt funds help you beat inflation and provide income but don’t give you the upside potential that you would get in an equity fund.

If you need a mix of safety and growth, a balanced fund could be the answer. A balanced fund usually has a stock component and a bond component. It provides safety, income and some capital appreciation. You could also choose balanced funds that have a high equity component, if you are looking for growth or funds that are skewed in favor of debt if you are looking for income and security. If you have a short investment horizon and looking for security then a balanced fund with a high debt component could be suitable.

It’s always a good idea to diversify – don’t put all your eggs in one basket, even if you have long terms goals and are a risk taker. Consider buying gold, investing in debt and equity funds as well – the percentages can vary based on your requirement. You never know how the future will pan out and it’s better to cover all basis while always keeping in mind your goals.

Now that you have the knowledge you need, go ahead, find out how you can start investing.

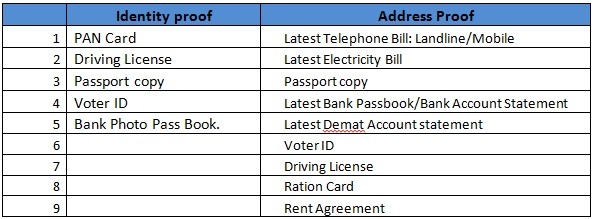

The form can be downloaded from this location:

The form can be downloaded from this location: